Where To Enter Crypto In Turbotax

Cryptocurrencies Where To Enter Crypto In Turbotax are all the rage right now, and for good reason. They offer some pretty cool benefits over traditional currencies, like greater degrees of anonymity and security. But where do you start if you want to get involved? One option is to enter your crypto holdings into your tax return. Here are five steps to follow in order to get started.

What is a Cryptocurrency?

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services. Some cryptocurrencies have been associated with illegal activity, but others are used by investors and traders worldwide.

How to Buy Cryptocurrencies

If you have never purchased or traded cryptocurrencies before, it may be helpful to first learn about the basics of how they work. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

There are a variety of ways to purchase cryptocurrencies: you can buy them online, through a brokerage account, or from a physical store. Before you purchase any cryptocurrencies, make sure you understand how they work and what risks there are associated with them.

To purchase cryptocurrencies online, you will first need to open an account with a cryptocurrency exchange. Once you have an account, you will be able to deposit money into your account and then purchase cryptocurrencies using that deposited money. There are many cryptocurrency exchanges available, so it is important to do your research before choosing one.

To purchase cryptocurrencies through a brokerage account, you will need to first find a brokerage firm that offers cryptocurrency trading services. After you have found a brokerage firm that offers this service, you will need to open an account with them and then deposit money into your account in order to trade cryptocurrencies. You will also need to understand the fees associated with trading cryptocurrencies through a brokerage account.

Finally, if you want to purchase cryptocurrencies from a physical store, be sure to inquire about whether they offer this service. Some stores may only offer this service in certain areas of the country; therefore, it

How to trade Cryptocurrencies

If you’re trading cryptocurrencies, you’ll need to have a digital wallet where you can store your assets. A digital wallet is an app or online service that lets you manage your cryptocurrency assets. You can also use a digital wallet to buy and sell cryptocurrencies.

To trade cryptocurrencies, you’ll need to find an exchange. An exchange is a platform where you can buy and sell cryptocurrencies. There are several exchanges available, including Kraken, Bitfinex, and Binance.

Before you start trading cryptocurrencies, it’s important to understand how they work. Cryptocurrencies are based on blockchain technology. This is a distributed database that records all transactions made with the cryptocurrency.

To trade cryptocurrencies, you’ll need to know how much of each cryptocurrency you want to buy and sell. You can use an online calculator like CoinMarketCap to figure out the price of a given cryptocurrency.

Tax implications of Cryptocurrencies

Cryptocurrencies are gaining in popularity as an investment vehicle, but there are tax implications to consider. For individuals who want to invest in cryptocurrencies, the IRS has created specific rules for capital gains and losses. In general, when you sell a cryptocurrency, you will have to report the sale and pay taxes on the profits.

If you hold onto a cryptocurrency, you may not have to pay taxes on it like you would if you sold it. This is because holding a cryptocurrency is considered taxable income. You can also use cryptocurrencies to reduce your taxable income by making contributions to retirement accounts or paying off debts.

The best way to understand how cryptocurrency works and tax implications is by consulting with a tax advisor.

Conclusion

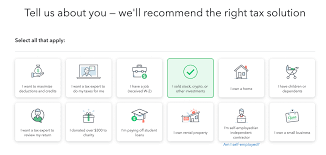

If you’re looking to invest in cryptocurrencies but Where To Enter Crypto In Turbotax don’t know where to start, TurboTax might be the perfect solution! With our easy-to-use Crypto Investing feature, you can easily enter your holdings and get a detailed report on your profits and losses. Plus, our Tax Preparation Services will help you structure your transactions in a way that maximizes your potential tax breaks. So whether you’re an experienced investor or just getting started, TurboTax is Where To Enter Crypto In Turbotax the perfect platform for you!