Where Do I Put Crypto In Turbotax

Are you new to the world of cryptocurrency and wondering how to report it on your taxes? You’re not alone! With the rise in popularity of digital currencies, many people are left scratching their heads when it comes time to file. Luckily, Turbotax has made it easy for you to include your crypto earnings in your tax return. In this blog post, we’ll walk you through where to enter your crypto transactions in Turbotax and help make tax season a breeze.

What is Crypto

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

What are the Benefits of Cryptocurrencies

Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are unique in that they utilize decentralized control and verification of transactions by network nodes through a process called mining. This allows for a highly secure and transparent system. Some benefits of cryptocurrencies include:

-Autonomy: Cryptocurrencies are not subject to government or financial institution control, which gives them a degree of autonomy and independence.

-Fungibility: Cryptocurrencies are interchangeable, meaning that one token is equivalent to another on the blockchain. This allows for greater liquidity and an increased number of potential users.

-Decentralization: Cryptocurrencies are decentralized, meaning they are not subject to centralized control. This allows for greater trust in the system and increased security.

-Privacy: Cryptocurrencies allow for complete privacy when conducting transactions, as all information is encrypted.

How to Buy Cryptocurrencies

Cryptocurrencies are decentralized digital tokens that use cryptography to secure their transactions and to control the creation of new units. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

To buy cryptocurrencies, you will need a digital wallet where you can store your tokens. Many wallets offer an easy way to buy and sell cryptocurrencies, and some even offer support for other cryptocurrencies.

To learn more about how to buy and use cryptocurrencies, consult the following resources:

What To Do With Your Cryptocurrency

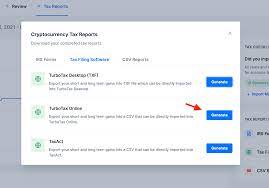

There are a few options for where to put your cryptocurrency in TurboTax. In TurboTax 2017, you can:

1. Put cryptocurrencies in the “General Income” section of your tax return.

2. Convert cryptocurrencies into US dollars and include them as ordinary income on your tax return.

3. Sell cryptocurrencies and deduct the proceeds from your taxes.

4. Use a cryptocurrency IRA or Roth IRA to hold cryptocurrencies.

5. Use a custodian to hold cryptocurrency for you, like Coinbase or Xapo.

Conclusion

Crypto is a hot topic and many people are looking to invest in it. However, not everyone understands how to properly invest in it and where to place their money. In this article, we will discuss where you should put your crypto in order to minimize risk while maximizing returns. We will also provide a few tips on how to invest in crypto so that you can be successful!