What Does Slippage Mean In Crypto

Are What Does Slippage Mean In Crypto you new to the world of cryptocurrency trading and wondering what the term “slippage” means? Or are you a seasoned trader looking to refine your skills and reduce potential losses? Whatever your level of experience, understanding slippage is crucial for successful crypto trading. In this blog post, we’ll explore what slippage is, why it occurs, and how you can mitigate its impact on your trades. So strap in and let’s dive into the world of slippage in crypto!

Definition of Slippage

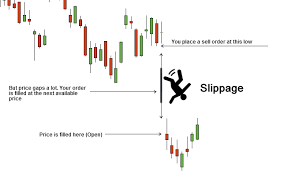

Slippage is a term used in the world of finance to describe the amount by which the price of a security (or futures contract) falls below its expected value. In other words, slippage reflects the degree to which the market is under- or over-pricing a security. Slippage can also be measured as a percentage of change from the closing price.

One of the reasons for slippage is that investors often buy and sell securities at different prices, resulting in what’s called “market order trading.” This means that there are always more buyers than sellers in any given security, which drives down its price. However, when demand decreases (i.e., when there are more sellers than buyers), the security’s price can fall even further because there are fewer buyers willing to pay more for it.

Another reason for slippage is “information overload.” When many people are trying to buy or sell a particular security at once, it becomes difficult to get accurate pricing information. This can lead to wild swings in prices as traders react to rumors and speculation rather than actual factual information about a particular stock or commodity.

Causes of Slippage

There are a few common causes of crypto slippage.

The first is that investors may not fully understand how cryptocurrencies work and how they interact with the rest of the market. This can cause them to make rash decisions when it comes to investing, which can lead to losses in the short term.

Another issue is that digital assets are volatile and often unpredictable. This means that prices can go up or down rapidly, which can lead to sudden losses in holdings if people don’t have enough cushioning.

Finally, there’s the risk of hacks and scams. If someone hacks into a cryptocurrency exchange or a digital wallet, they could steal funds or create fake coins that crash the market.

How to Prevent Slippage in Crypto Trading

When you are trading cryptocurrencies, it is important to be aware of the risk of slippage. Slippage typically refers to the amount of money you lose as a result of inaccurate or delayed information. The more time that passes between when you execute a trade and when you receive the relevant market data, the greater the potential for slippage.

There are various things you can do to minimize the risk of slippage in your trading activities:

1. Make sure you have a good trading platform and tools that work well for you. This includes an accurate charting program, reliable real-time data feeds, and advanced technical analysis tools.

2. Stay disciplined – don’t overtrade and don’t let yourself get emotionally attached to your positions. If something goes wrong, stay calm and keep moving forward until everything is resolved.

3. Use stop orders if appropriate – this will help protect your position in case of sudden market changes that may cause your order to get filled at a lower price than what you were hoping for.

Conclusion

Slippage in crypto can be frustrating, but it doesn’t mean that you’re doomed to lose money. Keep your losses small and don’t get too discouraged if the price of a coin drops for a few hours or even days. Instead, focus on understanding why the price dropped and what you need to do to make sure that it doesn’t happen again.