How To Take Profits In Crypto

Cryptocurrencies How To Take Profits In Crypto are all the rage, and for good reason. They offer a unique way of conducting transactions that is safe and secure. However, not all cryptocurrencies are created equal. In this blog post, we will explore the basics of cryptocurrency investing and show you how to take profits in these volatile markets.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions and to control the creation of new units. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Instead, they are operated by a network of users who run software on their computers to help maintain the blockchain database. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services online.

What are the Benefits of Cryptocurrency Investing?

Cryptocurrency investing is a hot trend right now, and for good reason. Cryptocurrencies are digital or virtual tokens that use cryptography to secure their transactions and to control the creation of new units. They can be stored in online wallets or on specific exchanges.

The benefits of cryptocurrency investing are many and varied. Here are just a few:

1. You Can Easily Get Started with Cryptocurrency Investing

Cryptocurrencies are decentralized, meaning they aren’t subject to government or financial institution control. This makes them appealing to investors who dislike the centralized nature of traditional securities markets. You can easily get started by either purchasing coins off of an exchange or mining them yourself – this involves using your computer’s processing power to solve complex math problems in order to create new units of the currency.

2. Cryptocurrencies Are Volatile But Experienced Significant Gains in Recent Months

Cryptocurrencies were relatively unknown just a few years ago, but they’ve experienced significant gains in recent months due to investor interest. Bitcoin, for example, has seen its value increase by more than 1,000% since the beginning of the year! While cryptocurrencies are volatile and prone to large swings in price, this also makes them very risky – so you should only invest what you’re willing to lose!

3. There’s No Need To Deal With Legally Binding Documents Or Banks When Trading Cryptocurrencies

One big advantage of trading cryptocurrencies is that there’s

How to take profits in cryptocurrency

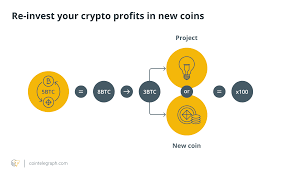

Profits in cryptocurrency can come in many different forms, but the most common way to take profits is by selling your coins when they are at their highest value and buying them back at a lower price. Another common way to take profits is by trading cryptocurrencies on an exchange. When you buy a cryptocurrency, you are essentially investing in it, and you hope that the price will go up. If the price goes up too high, you may want to sell what you’ve bought and invest in another currency or asset. Trading cryptocurrencies allows you to make quick decisions about whether or not to buy or sell a currency, which can be useful if you are trying to day trade or invest in a specific coin.

Conclusion

Taking profits in crypto can be a difficult and complex process, but with a little bit of time and effort it is definitely possible to make some serious cash. Whether you are looking to make short-term gains or long-term capital investments, taking profits is an essential part of any successful crypto trading strategy. By following these simple steps, you can dramatically increase your chances of success: