How To Read Candlesticks Crypto

Are How To Read Candlesticks Crypto you looking to unlock the mysteries of crypto trading? Do candlestick charts leave you scratching your head with confusion? Fear not, because we’re here to help! In this blog post, we’ll take a deep dive into the world of reading candlesticks in crypto trading. From understanding bullish and bearish patterns to identifying trends and making informed trades, you’ll become a pro at deciphering these important indicators. So grab your favorite beverage, get comfortable, and let’s delve into how to read candlesticks in crypto like a boss!

What is a Candlestick Chart?

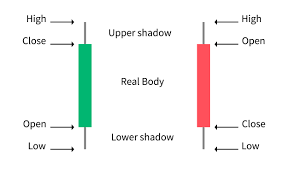

A candlestick chart is a graphical representation of prices over time. It normally displays the open, high, low and close prices for a particular security or commodity. Candlestick charts can be used to identify patterns and trends in price movement.

Types of Candlesticks

There are many different types of candlesticks, each with its own purpose. Here’s a brief overview of the most common ones.

The Bullish 6-day Candlestick: This type of candlestick shows that the security is strong and that demand is high. The opening and closing prices are higher than the middle price, which signals that there is a lot of buying pressure.

The Bearish 6-day Candlestick: This type of candlestick shows that the security is weak and that demand is low. The opening and closing prices are lower than the middle price, which signals that there is a lot of selling pressure.

The Engulfing 5-day Candlestick: This type of candlestick shows strong demand over a short period of time by showing that the market has been buying steadily throughout the day. The strongest part of this candle usually corresponds to the highest point in the trading volume for that day.

How to Read Candlesticks Crypto

Candlesticks are a graphical tool used in technical analysis to show the current state of a security. Candlesticks show the price and volume over time on the chart, allowing you to see how prices have changed over a specific period.

To use candlesticks, first select the currency or market you’re interested in. Next, open the candlestick charting software of your choice. Once open, locate the “candles” section on the bottom left corner of the chart. This will display all of the candles that have been created for this particular timeframe.

There are four main types of candles: bulls, bears, hints, and flags. Bulls represent buy orders and bears represent sell orders. Hints and flags indicate whether or not there is congestion on either side of the market. When looking at a bull candle, for example, you want to see high volumes surrounded by numerous bullish candles (bulls). When looking at a bear candle, you want to see low volumes with few bullish candles (bears).

Once you’ve identified which type of candle you’re examining, look at its size and color. The color will represent how much volume was generated during that timeframe; red means more volume was generated than green means less volume was generated. The size will indicate how big of an impact that candle had on price; small candles mean less impact while large candles mean more impact.

Conclusion

In this article, we covered what candlesticks are and how to read them for information about the price of a cryptocurrency. Candlesticks can be quite helpful when it comes to gauging the health of a cryptocurrency, as well as its overall trend. We hope you found our guide helpful and that you will use candlesticks in your trading practices moving forward!