How To Enter Crypto Into Turbotax

Are How To Enter Crypto Into Turbotax you a cryptocurrency investor scratching your head over how to properly report your holdings come tax time? Fret no more, as we have the ultimate guide on how to enter crypto into TurboTax! Whether you’ve been in the game for years or just starting out, our step-by-step instructions will make filing your taxes a breeze. So sit back, grab a cup of coffee and let’s dive into the world of crypto taxation with TurboTax.

What is Crypto?

Crypto is a digital or virtual currency that uses cryptography for security. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Cryptocurrencies are often traded on decentralized exchanges and can also be used to purchase goods and services.

What is a Cryptocurrency Exchange?

Cryptocurrencies are digital or virtual tokens that use cryptography for security. Cryptocurrency exchanges allow you to buy and sell cryptocurrencies.

Cryptocurrency exchanges are websites where you can buy and sell cryptocurrencies. There are many cryptocurrency exchanges, but the most popular ones include Coinbase, Binance, Kraken, and Bitfinex.

To buy cryptocurrencies on a cryptocurrency exchange, you first need to create an account. You will need to provide your name, email address, and password. After creating your account, you will need to verify your identity by providing a copy of your government-issued ID or driver’s license. Finally, you will need to fund your account with fiat currency (dollars, euros, etc.).

To sell cryptocurrencies on a cryptocurrency exchange, you first need to find an offer for the coins you want to sell. You can find offers by searching the exchange’s search engine or by using the exchange’s order book. Once you find an offer for the coins you want to sell, you will need to place a buy order. The buy order will be placed at a price lower than the current market price of the coins you want to sell. Once your buy order is filled, the coins will be sold to you at this price.

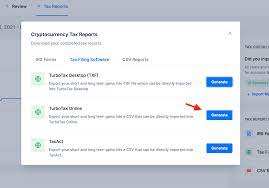

How to Enter Crypto Into Turbotax

If you are considering investing in cryptocurrencies, you may want to know how to enter them into your tax returns. Here is a guide on how to do it!

There are a few different ways to enter cryptocurrencies into your tax return.

The first way is to treat them like ordinary income. You would need to track the value of the cryptocurrency at the time you sold it or transferred it, and report that value on your tax return.

The second way is to treat them as long-term capital gains. This means that you would only have to pay taxes on the profits from selling or transferring the cryptocurrency, rather than on the value of the cryptocurrency at the time of sale or transfer.

The third way is to treat them as either property taxes or capital gains taxes depending on their use case. If they are used for purchase transactions (property taxes), then they will be treated as property taxes. If they are used for trading (capital gains taxes), then they will be treated as capital gains taxes.

whichever option you choose, make sure you follow all applicable tax rules and paperwork requirements!

Conclusion

If you’re thinking about investing in cryptocurrencies, now is the time to do it! Here are some tips on how to enter crypto into your Turbotax so you can track your profits and losses. By following these simple steps, you’ll be well on your way to making smart investment decisions that will benefit you both financially and emotionally. Thanks for reading!