What Is Spot Trading In Crypto

Spot What Is Spot Trading In Crypto trading is a form of trading where you buy and sell an asset at the same time, with the intent of reselling it immediately. This type of trading is often used in traditional markets, such as stocks or commodities. Cryptocurrencies are a relatively new type of financial asset, and spot trading them is still in its infancy. As a result, there is not yet a lot of liquidity available to traders. This means that prices can be volatile and unpredictable. If you’re looking to get into spot trading cryptocurrencies, be prepared for some bumps in the road. However, if you have the stomach for it and are willing to risk your money, spot trading could be the perfect way to make some quick bucks.

What is spot trading?

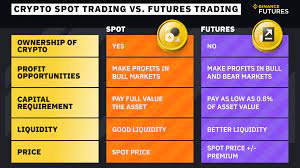

Spot trading is where traders sell and buy cryptocurrencies at a set price, usually determined by the current market price. This allows for more frequent and accurate price fluctuations, which can lead to greater profits. Spot Trading is different from futures trading, which involves buying and selling contracts that will expire in the future.

What are the benefits of spot trading?

There are a number of benefits to spot trading in cryptocurrency. For starters, it allows for more frequent and rapid price changes. This is great for traders who want to take advantage of sudden movements in prices. Spot trading also provides a more accurate snapshot of the current market conditions, as opposed to trading on an exchange where orders can be filled at different prices depending on the time of day. Finally, spot trading makes it easier to hedging your bets – if you think the price of a particular cryptocurrency is going to go down, you can sell short and wait for the price to fall further before buying back in again.

How to start spot trading in crypto

Spot trading is a trading strategy in which an investor buys and sells securities at immediate price fluctuations, instead of holding onto the security until it reaches a predetermined price. It can be used in any market, including cryptocurrencies.

There are many benefits to spot trading. For one, it gives you the opportunity to make instant profits or losses. If the price of a security goes up, you can sell and make a profit. If the price of a security goes down, you can buy and hold, making minimal losses.

Additionally, spot trading allows you to exploit opportunities that may not be available on other exchanges. For example, if you see a security that is about to hit its expiration date but is still relatively cheap, you can buy it and hold it until the expiration date without having to worry about it going up in price later on.

To start spot trading in crypto, first find an exchange that offers spot trading. Then open an account with that exchange and deposit money into your account. Next, find the security you want to trade and click on “buy” or “sell” next to it. Enter the amount of bitcoin or altcoin you want to buy or sell and click on “submit”. The exchange will then execute your trade for you instantly.

When to stop spot trading in crypto

When to stop spot trading in crypto

Spot trading is the practice of buying and selling cryptocurrencies on a moment-by-moment or intra-day basis. This type of trading allows you to take advantage of short-term price movements, but it’s also riskier because you can’t hold onto your coins for long.

If you’re new to cryptocurrency trading, there’s no need to start spot trading right away. Stick with longer-term trades that allow you to build up a position over time. Once you’ve become comfortable with the market, then try spot trading as an added bonus.

But be aware that spot trading is risky and should only be used as a supplementary tool for making larger profits. If you lose money when Spot Trading, it’s not the end of the world – but it will likely slow down your overall investment growth.