How Much Leverage Is In Crypto

Are How Much Leverage Is In Crypto you curious about the mysterious world of cryptocurrency and wondering just how much leverage it holds? As more people become intrigued by the potential profits and risks associated with digital assets, it’s important to understand what “leverage” means in this context. Whether you’re a seasoned trader or just dipping your toes into the crypto waters, this blog post will provide valuable insights on how leverage works in cryptocurrency trading and what factors can impact its effectiveness. So buckle up and get ready to dive deep into the exciting realm of crypto leverage!

What is Leverage?

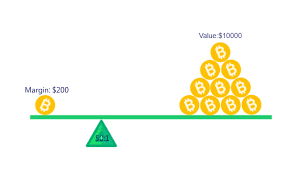

Leverage is the use of debt to amplify returns on an investment. In other words, it allows you to control more assets than you could otherwise afford with your own capital.

For example, let’s say you want to buy $100 worth of Bitcoin. But you only have $10. You could borrow the remaining $90 from a broker that offers leverage, and then use your $10 as collateral. Now you have control over $100 worth of Bitcoin.

If the price of Bitcoin goes up by 10%, your investment will be worth $110 – giving you a profit of $10. If the price goes down by 10%, your investment will be worth $90 – meaning you’ll owe the broker $10.

This is why leverage is a double-edged sword: it can amplify both profits and losses. That’s why it’s important to use stop-loss orders when trading with leverage, to limit your downside risk.

How Much Leverage Is There In Crypto?

The short answer is that there is a lot of leverage in crypto. For example, with Bitcoin you can get up to 100x leverage on some exchanges. That means that for every $1 you have in your account, you can trade up to $100 worth of Bitcoin.

Of course, with great leverage comes great responsibility. You need to be very careful when trading on leverage, as it can magnify both your profits and your losses. Make sure you always do your research and only trade with money you can afford to lose.

How to Use Leverage Safely in Crypto Trading

When it comes to trading cryptocurrencies, leverage can be a powerful tool – but it can also be dangerous if used improperly. In this article, we’ll take a look at how to use leverage safely in crypto trading.

First, let’s define what we mean by leverage. In the context of trading, leverage is the use of borrowed capital to increase one’s potential return on investment. For example, if you’re trading with 2:1 leverage, for every $1 you have in your account, you can trade $2 worth of cryptocurrency.

Now that we’ve got that out of the way, let’s talk about how to use leverage safely. The key here is to not over-leverage your position. That is, don’t borrow more money than you can comfortably afford to lose. Remember: Leverage magnifies both gains and losses. So if you’re only comfortable losing $100, don’t trade with more than $200 worth of borrowed capital.

Another important safety tip is to always use stop-loss orders when trading with leverage. A stop-loss order is an order that automatically sells your position when it reaches a certain price – which you determine in advance. This helps limit your downside risk in case the market moves against you.

Finally, make sure you understand the risks involved with margin trading before getting started. Margin trading is basically borrowing money from a broker to trade with – and if done incorrectly, it can lead to some very steep

The Pros and Cons of Leverage in Crypto Trading

When it comes to trading cryptocurrencies, one of the key things to consider is how much leverage to use. Leverage can be a great tool for traders, allowing them to take on more risk and potentially make more profits. However, it also comes with its own risks, and if not used correctly can lead to heavy losses. In this article, we’ll explore the pros and cons of using leverage in crypto trading so that you can make an informed decision about what’s right for you.

Leverage can be a great way to increase your profits potential in cryptocurrency trading. By taking on more risk, you open yourself up to the possibility of making larger gains than you would if you were simply trading with your own capital. Of course, with greater risk comes the potential for greater losses as well, so it’s important to use leverage wisely and only take on as much risk as you’re comfortable with.

Another advantage of using leverage is that it allows you to trade with less capital than you would need if you were trading without leverage. This can be helpful if you don’t have a large amount of money to start with, or if you’re looking to free up some capital for other investments. Keep in mind though that because your profits are magnified when using leverage, your losses will also be magnified. So it’s important to only use as much leverage as you’re comfortable with and always have stop-losses in place to protect yourself from heavy losses.

While

Conclusion

Leverage in cryptocurrencies can bring huge potential profits but also carries a large amount of risk. It is important to understand the concept thoroughly and familiarize yourself with all the risks before considering taking advantage of it. We hope this article has given you an insight into the world of crypto leverage trading, so that you can make educated decisions and stay informed about the latest developments in this field. Good luck!